Oh My Gosh! My wedding is coming up next week and I am low on funds, what do I do? Say no more, personal loans are always there to bridge the gap.

Numerous companies are running personal loan programs you must have stumbled across. Personal loans are borrowed cash that can be used to fund large purchases, urgent expenses such as weddings, funerals, and even home improvements, and much more. That sounds simple, right?

To be able to access personal loans conveniently you can search for loans places near me. Ready and Easy access to personal loans might sound enticing but before one applies one must consider both the merits and demerit.

What Is Personal Loan?

A personal loan is a cash lifeline that can help make a very huge purchase or consolidate high-interest debts. Most personal loans are unsecured meaning one does not need collateral to secure a personal loan unlike Mortgages where one home serves as collateral, there are some secured personal loans, in those secured personal loans the collateral may at times be the bank account of the borrower or any other property

Personal loans became well used after the 2008 financial crisis and are now one of the rapidly growing loans options in the loan market.

Read:- Want to Become a Business Administrator? Here’s How

Personal Loans For Bad Credit

Personal loans like any other type of loan have both upsides and downsides, it helps build one’s credit score.

Personal loans despite being unsecured still have a major downside being that the Inability to make payments timely can prove very harmful to one’s credit score and seriously limit your ability to obtain credit in the future.

FICO, the company behind the most widely used credit score, states that payment history makes up 35% of one’s credit score.

How Dangerous Are Personal Loans

Personal loans are both dangerous and not. Personal loans are important in building one’s credit score but the inability to pay on time during the repayment window affects credit score negatively.

Another dangerous effect of a personal loans is that the inability to pay the loans on time despite affecting ones credit score still accrues penalties. When you use untrustworthy lenders, one is more likely to experience high-interest rates which makes the borrower unable to pay.

Read:- The Main Benefits of Investing and How to Start

And, therefore, it makes the borrower secure another loan to offset the previous loan, therefore, causing a cycle of debt.

How To Avoid Dangerous Situations With Personal Loan?

#1 Take Loans Only When Necessary

Personal loans should only be taken when very necessary and after careful consideration of the factors involved like repayment time, interest rate, and flexibility of the lender. All these conditions must be considered before one takes a personal loan. It’s because, despite personal loans might prove an urgent source of cash but one has to bear the grunt of paying it for months which might run into years.

#2 Look For Lowest Interest Rates

Personal loans generally are characterized by a high-interest rate due to lack of collateral, as interest is high, a little reduction in the interest rate can prove very profitable so when is accessing personal loans, one should look out for loan options with low-interest rates.

#3 Make Timely Repayments

Whenever accessing a personal loan, you must be committed to paying off the loan within the repayment window. Timely payments prevent unwanted penalties which personal loan is characterized by and if paid off on time also helps build one credit score positively.

Read:- Business Startup Checklist: A Guide for Your Business

#4 Shorten Loan Tenure

Most Personal loans are characterized by a long repayment window despite the long repayment window that might sound interesting and permit repayment over a long period of time. The interest accrued over time might be very high. But if the repayment window is short one can easily pay off and maximize the interest rate.

#5 Look Closely For Additional Charges

When one is considering a personal loan, one must be careful of other additional charges other than the interest rate and duration of payment. One must look out for additional charges like processing fee, origination fee, prepayment penalty e.t.c.

#6 Do a Thorough Research Before Applying For Personal Loan

With the rapid increase of personal loans provider and their claims, when one wants to apply for a personal loan, one should be careful not to be swept off by their attractive loan offer without reading the terms and conditions.

Read:- A Few Tips How to Promote Your Business Online

When accessing a personal loan, one should read the terms and conditions thoroughly, the individual should go as far as doing thorough research into the lender’s portfolio. One can also do a comparison between lenders and consider the one with the lowest interest, repayment window, and lesser additional charges.

Effect of the Pandemic on Personal Loans

During the pandemic, almost everything about the economy was affected quite negatively, so did the personal loan.

According to The Forbes Advisor

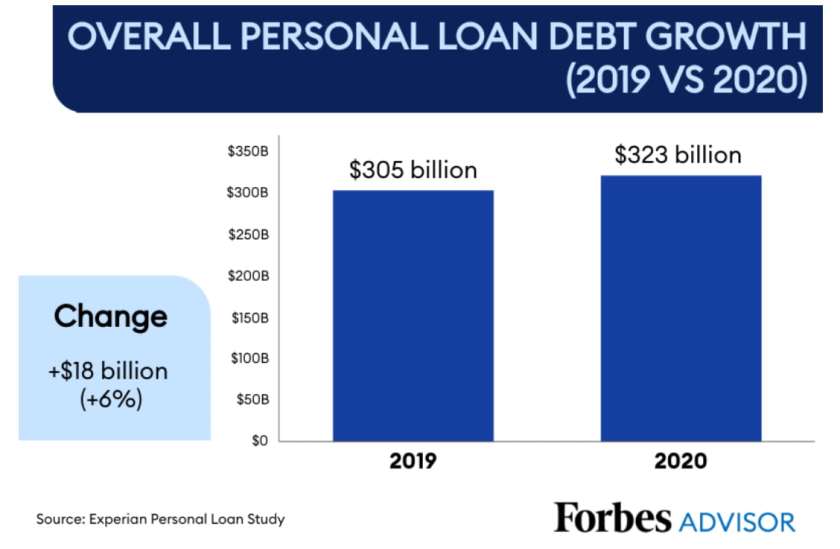

- Personal loan debt growth slowed

- Outstanding loan debt increased by $18 billion

- Consumers opened 3.1 million new accounts

- New loan originations fell 26.5%

- The average loan size fell by $1,197

- Refinancing credit cards and consolidating debt were common uses

Demography

According to The Ascent:

- In June 2020, 20% of Americans with personal loans were concerned about their ability to pay their personal loan.

- The number of personal loans in hardship increased from 3.58% in April 2020 to 6.15% in May.

- Only 0.28% of personal loans were in hardship in May 2019.

Conclusion

Personal loans might prove to be a good source of a credit line, but one should be very careful about the types and nature of loans and lenders or it might be the end of one’s credit score.

According to The Forbes Advisor, in years past, consumers increasingly turned to personal loans when they needed cash, making this type of financing one of the fastest-growing forms of debt.

Personal loan debt grew 12% in 2019 compared to 6% in 2020, according to data from Experian, one of the three primary credit bureaus. Consumers owed $323 billion on personal loans in 2020, an all-time high, up to $18 billion from 2019.